New orders in the first quarter of fiscal 2024 amounted to €22.3 billion (first quarter of fiscal 2023: €22.6 billion), up 2% on a comparable basis

Revenue increased 6% on a comparable basis to €18.4 billion (1QFY2023: €18.1 billion)

Total Industrial Business profit reached €2.7 billion (1QFY2023: €2.7 billion) and physical business margin increased to 15.8% (1QFY2023:15.7%)

Group level free cash flow increased significantly from the same period last year to €1 billion (1QFY2023: €100 million)

Net income increased 56% to €2.5 billion (1QFY2023: €1.6 billion)

Confirms guidance on performance targets for fiscal year 2024

The Annual General Meeting of Siemens Online will decide on a proposed dividend of €4.70 per share for FY2023 (FY2022: €4.25)

Siemens achieved a successful start with strong results in the first quarter of fiscal year 2024 (ending December 31, 2023). Physical profits reached €2.7 billion, with almost all physical profits increasing, setting a new record for the first quarter of the financial year. On this basis, Siemens confirms its guidance for fiscal year 2024. As Siemens announced in November 2023, the company will launch a new share repurchase program in the near future, which will complete a total share repurchase of up to 6 billion euros over a maximum period of five years.

“Once again, Siemens delivered an excellent quarter, maintaining profitable growth momentum. By deepening our partnership with Microsoft and Amazon Cloud Technologies, we are making AI easier to apply.” “Our customers look to Siemens as a trusted technology partner to support their digital transformation and sustainability,” said Roland Busch, Chairman, President and CEO of Siemens AG.

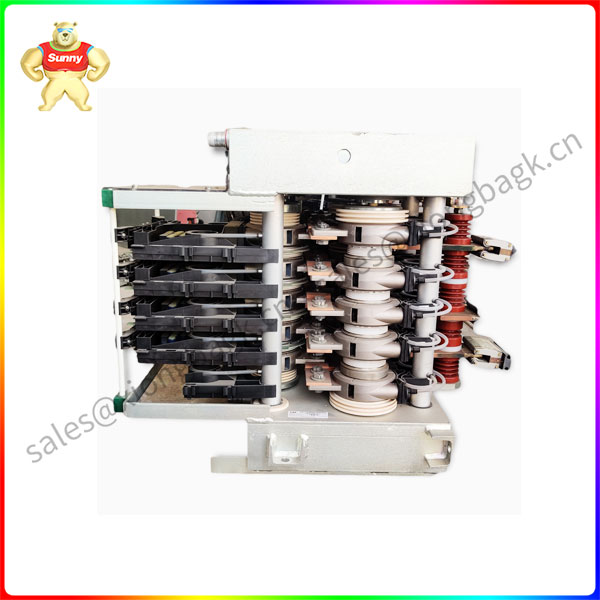

S-073N 3BHB009884R0021 ABB

“Siemens’ free cash flow grew to €1 billion, well ahead of the same period last year. Going forward, we continue to maintain strong team execution capabilities and confirm our guidance for fiscal 2024.” Added Ralf P. Thomas, chief financial officer of Siemens AG.

Physical business profits hit a record high for the first quarter of a fiscal year

In the first quarter of fiscal 2024, Siemens’ revenues increased by 6% on a comparable basis (i.e. excluding the impact of currency movements and business mix) to €18.4 billion (Q1 2023: €18.1 billion). New orders increased by 2% on a like-for-like basis to €22.3 billion (Q1 FY2023: €22.6 billion). The book-to-bill ratio was strong at 1.21. Reserve orders totalled €113 billion, a record high.

Total profit from the physical business reached €2.7 billion, up 3% and a record high for the first quarter of the fiscal year (1QFY2023: €2.7 billion). Physical business margin improved to 15.8% (1QFY2023:15.7%). Net income increased by 56% to €2.5 billion (1QFY2023: €1.6 billion), a strong increase that included a €500 million gain on the investment in Siemens Energy. Previously, Siemens transferred 8.0% of its shares in Siemens Energy AG to Siemens Pension Trust and terminated the equity method of accounting. Based on net income before purchase price apportionment, basic earnings per share were €3.19, 53% higher than in the same period of the previous fiscal year (1QFY2023: €2.08).

Siemens’ free cash flow from continuing and non-continuing operations amounted to EUR 1 billion, a significant improvement over the same period last year (Q1 FY2023: EUR 100 million) and an excellent seasonal level. The increase was driven by a significant improvement in physical free cash flow of €1.3 billion (1QFY2023: €400 million).

The Smart Infrastructure business and the Siemens Transportation business performed strongly

Digital Industries Group revenues remained largely stable on a comparable basis at €4.6 billion. The growth in software revenue more than offset the decline in automation revenue, especially in some of the higher-margin products. New orders fell 31% on a like-for-like basis to €4 billion, mainly due to weaker market conditions in the automation business compared to the same period last year and continued customer destocking. Group profit fell 20 per cent to €895 million, mainly due to lower capacity utilisation and a product mix to be optimised. The profit margin was 19.6%.

In a challenging market environment, the Smart Infrastructure Group saw solid growth in new orders of 5.8 billion euros, matching the high level of the same period last year. The new order includes a number of large order contracts won. Revenues rose 9 per cent on a like-for-like basis to €4.8bn. All regions contributed to revenue growth, with increased demand in the data center and power distribution segments helping to weather the challenging macroeconomic environment, especially in short-cycle businesses. Profits rose 26 per cent to €885m. Profit margin was 18.3% (1QFY2023:15.3%). Both profit and profitability reached the highest level ever recorded by the Intelligent Infrastructure Group, also thanks to the positive impact of EUR 94 million from the repatriation of some liabilities related to past portfolio activities.

Siemens transportation revenue increased 12 percent on a comparable basis to 2.7 billion euros. New orders increased by 92% on a like-for-like basis to €5.6 billion, driven by an increase in the number of large orders. Siemens Transportation delivered double-digit revenue growth across its business lines, with particularly strong conversion of reserve orders in rail vehicles and rail infrastructure. Profits rose 29 per cent to €251m. The profit margin was 9.3 per cent. This included a positive impact of about one percentage point from some delayed effects related to Russia.

The dividend plan will be decided at the online meeting of the annual General meeting

Following the release of the quarterly financial data, the annual General meeting of Siemens AG was held. Siemens shareholders will vote on the proposal of the Management Board and Supervisory Board for a dividend of €4.70 per share for the fiscal year 2023. The proposed dividend per share represents an increase of €0.45 compared to the previous fiscal year, reflecting Siemens’ active dividend policy.

中文版

中文版